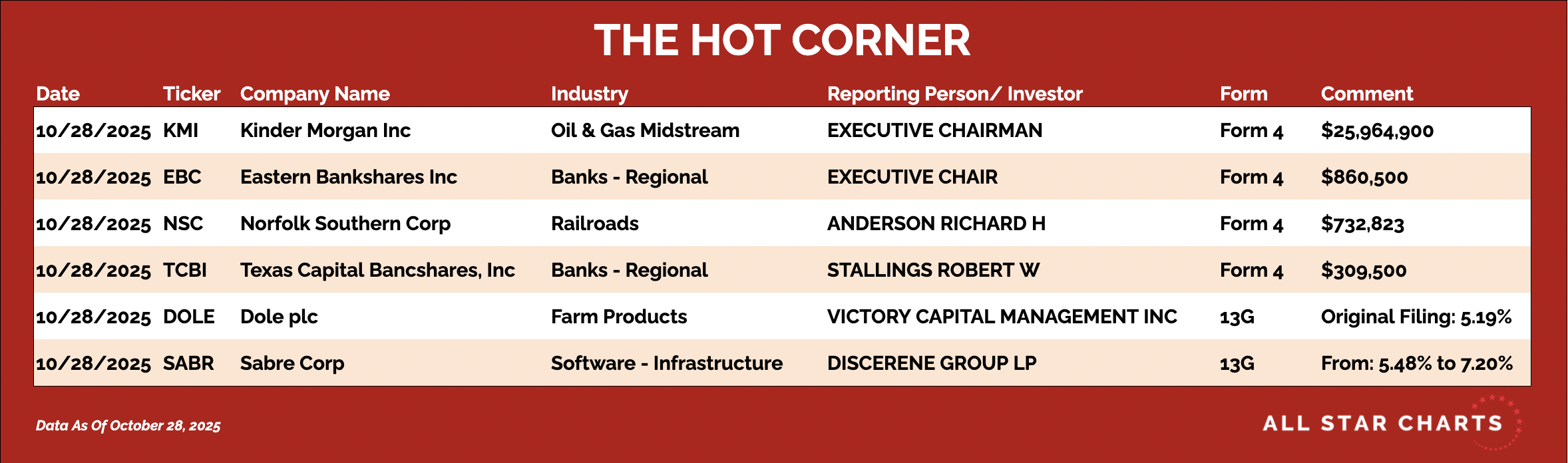

Executive Chairman Richard Kinder Reports a $26 Million $KMI Purchase

The recording and the chartbook for the October 27 Weekly Strategy Session are now available for Hot Corner Insiders.

Stay tuned. We'll be back Thursday with more insider activity.