We're Live On December 2nd at 1:00 p.m. Eastern

Days

Hours

Minutes

Seconds

Recent Wins Using This Exact Framework

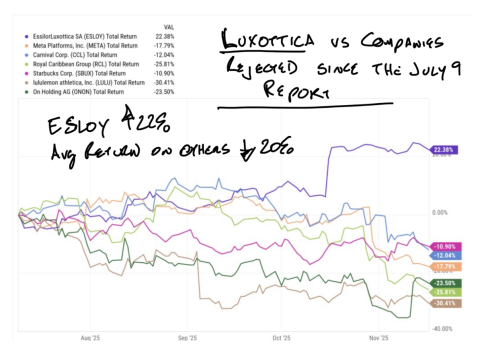

ESLOY

+22% after identifying AI-driven demand from Meta’s glasses

AEO

+37% after analyzing early reaction to the Sydney Sweeney campaign.

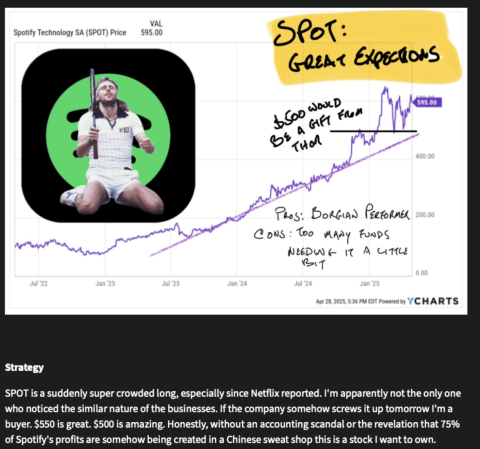

SPOT

16% after planning a dip-buy ahead of earnings.

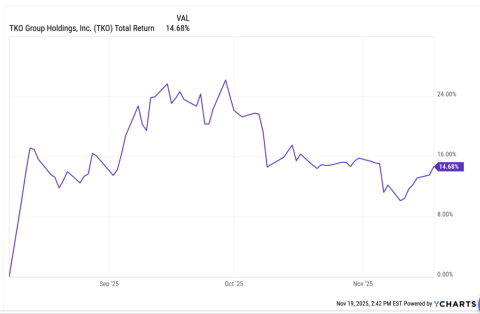

TKO

+11% following the Paramount deal.

These are the exact types of patterns he’ll dissect live.

Join Us Live Next Tuesday

📅 Date: December 2, 2025

🕒 Time: 1:00 p.m. ET

📍 Location: Live Online Broadcast

This is a free, live event. No credit card required.