🔎 Leaders Take a Breather

📊 Daily ETF Overview

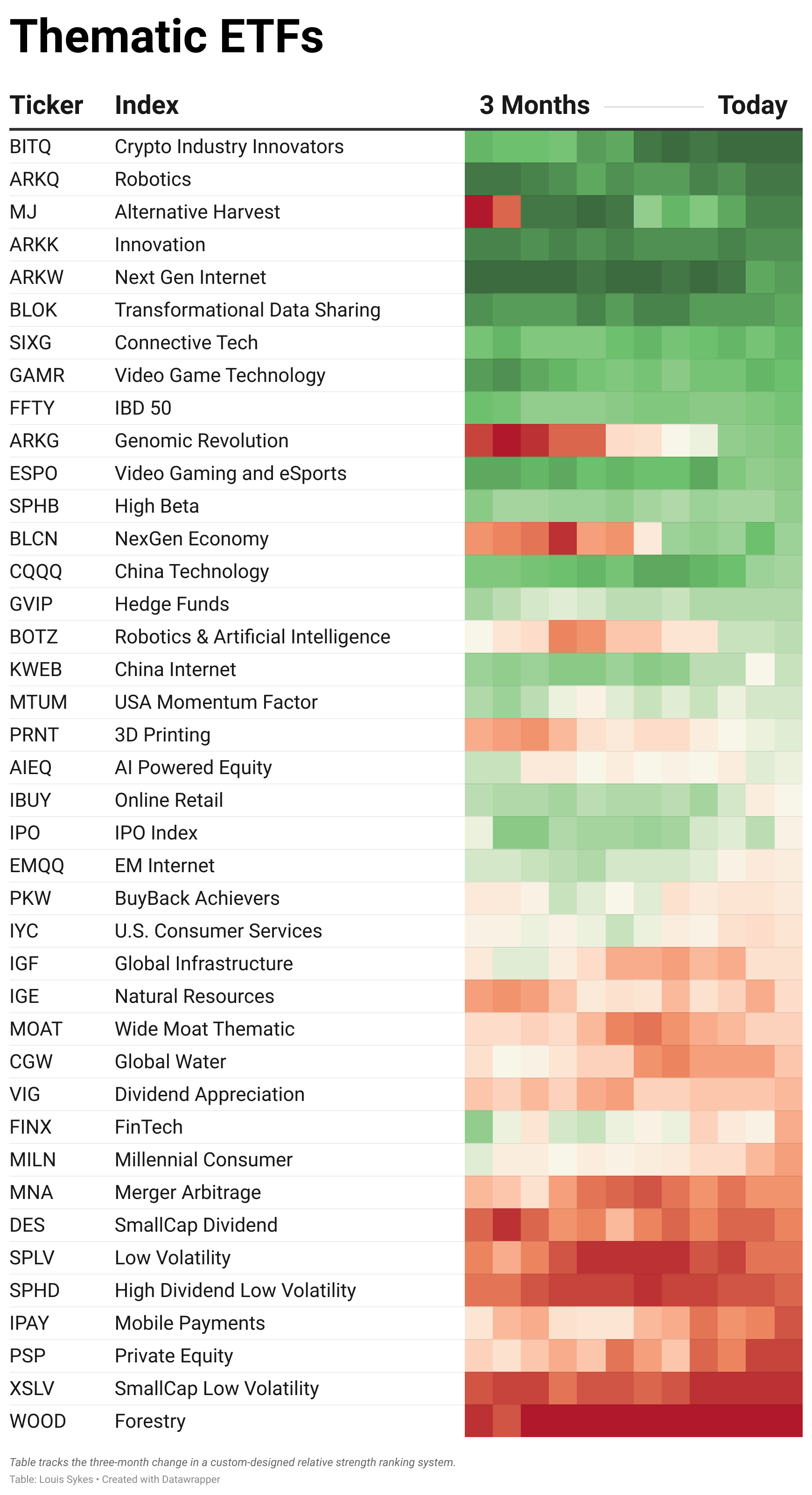

We're seeing some movement across our thematic universe.

Biotech and genomics have become an incredibly fat pitch. While many trends have already run their course to the upside, biotechs are only now beginning to resolve higher. Coupled with the rotation we're seeing into healthcare and small caps, this could be a theme with real legs.

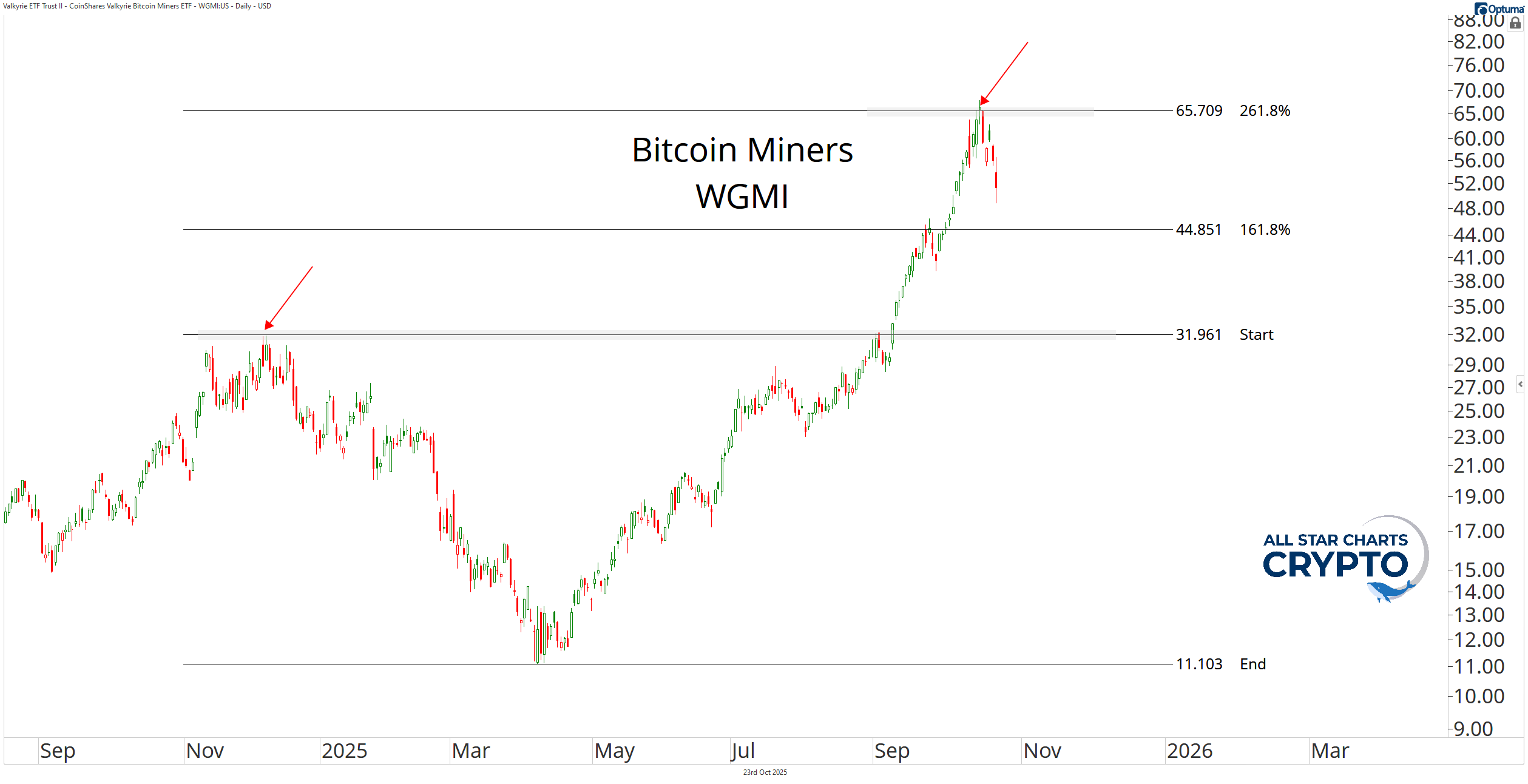

Meanwhile, many speculative growth trends are cooling off after what’s been a mighty run. Perhaps the most impressive of these have been the Bitcoin miners.

The industry has been reshaped by miners pivoting out of crypto and into AI. But now, it looks like that trend is ready to digest. The Valkyrie Bitcoin Miners ETF $WGMI has pulled back after hitting a critical Fibonacci target.

This kind of rotation—out of the leaders and into the laggards—is exactly what defines healthy participation in a bull market.

One area that’s certainly been weak in recent weeks is the crypto market, which has been stabilizing after the largest crash in its history.

But while fear runs high, we’re taking the other side of that trade.

Senior Crypto Analyst Louis Sykes will be going live with Steve Strazza on Monday at 4 p.m. ET to break down where capital is flowing and which coins are poised to benefit first.

When you register, you’ll also get a free report: “The Dip Traps: 5 Crypto Tokens Not Worth Buying.”