🔎 Tech Tops The Tables

📊 Daily ETF Overview

The market’s on fire, especially across tech and growth, as traders look ahead to this week’s FOMC meeting and earnings from the mega-cap heavyweights.

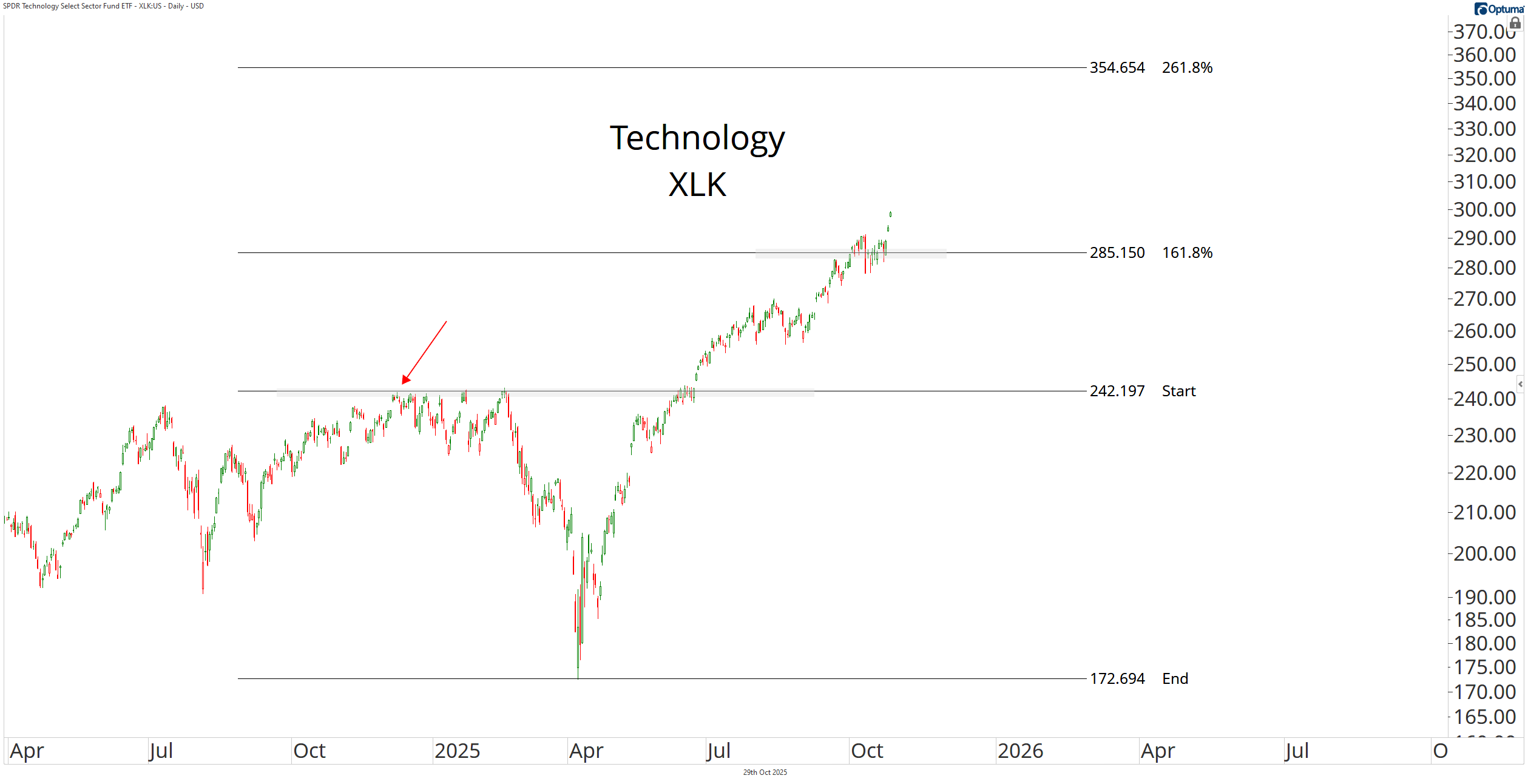

It’s a strong setup heading into those events. XLK just cleared a key Fibonacci extension, confirming the uptrend and opening the door to a fresh upside target around 350.

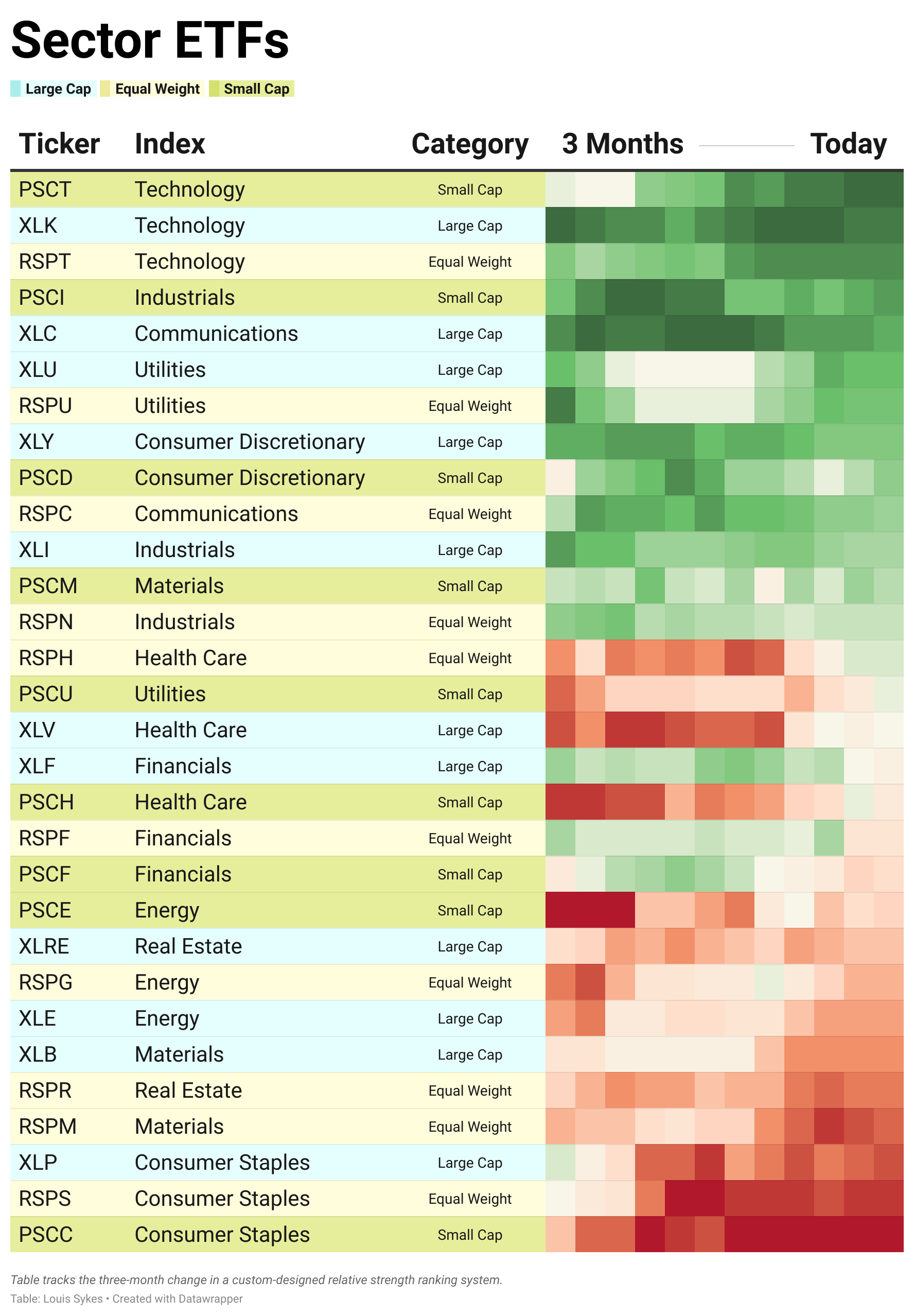

On our sector power rankings, technology continues to dominate — leading across large caps, small caps, and even equal-weight measures.

This is a sector that just keeps working.

While stocks are making all time highs, one of the most risk-on asset classes is trading a significant discount.

The crypto asset class saw its largest crash on record just a week ago — but that purge was more about positioning than fundamentals.

Think of it like Buffett after a market crash: when fear peaks, long-term opportunity begins.

The difference this time is that the strongest tokens are backed by institutional partnerships, real-world utility, and growing network effects. That’s where the next leadership will come from — and it’s already taking shape.

Senior Crypto Analyst Louis Sykes went live with Steve Strazza yesterday to talk about the seven best crypto investments while the rest of the asset class just got exposed as junk.

Click here to watch the replay.