🔎 The Consumer is on Breakdown Watch

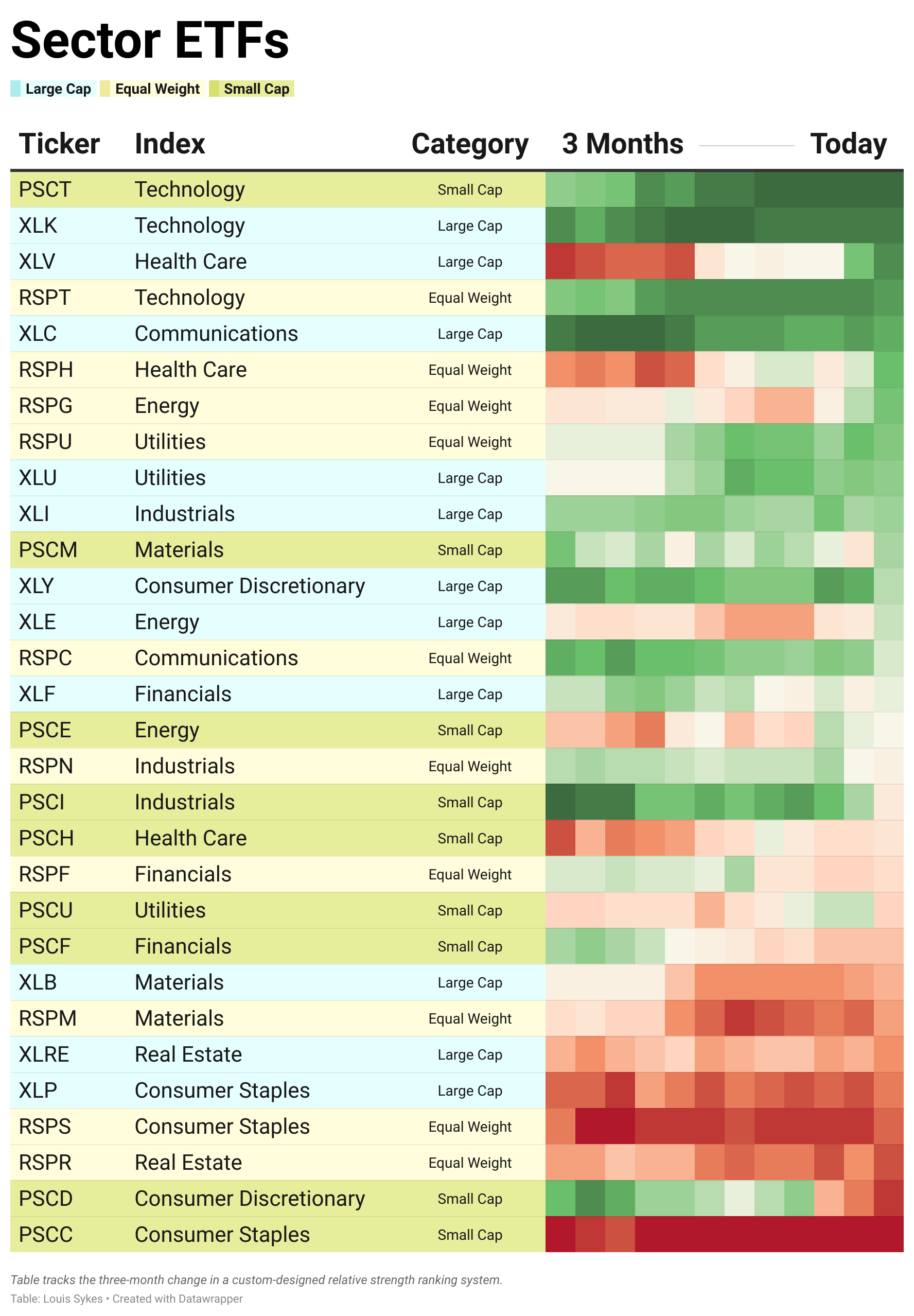

📊 Daily ETF Overview

While the S&P 500 and major averages sit just a stone’s throw from all-time highs, many sector ETFs are testing key support levels.

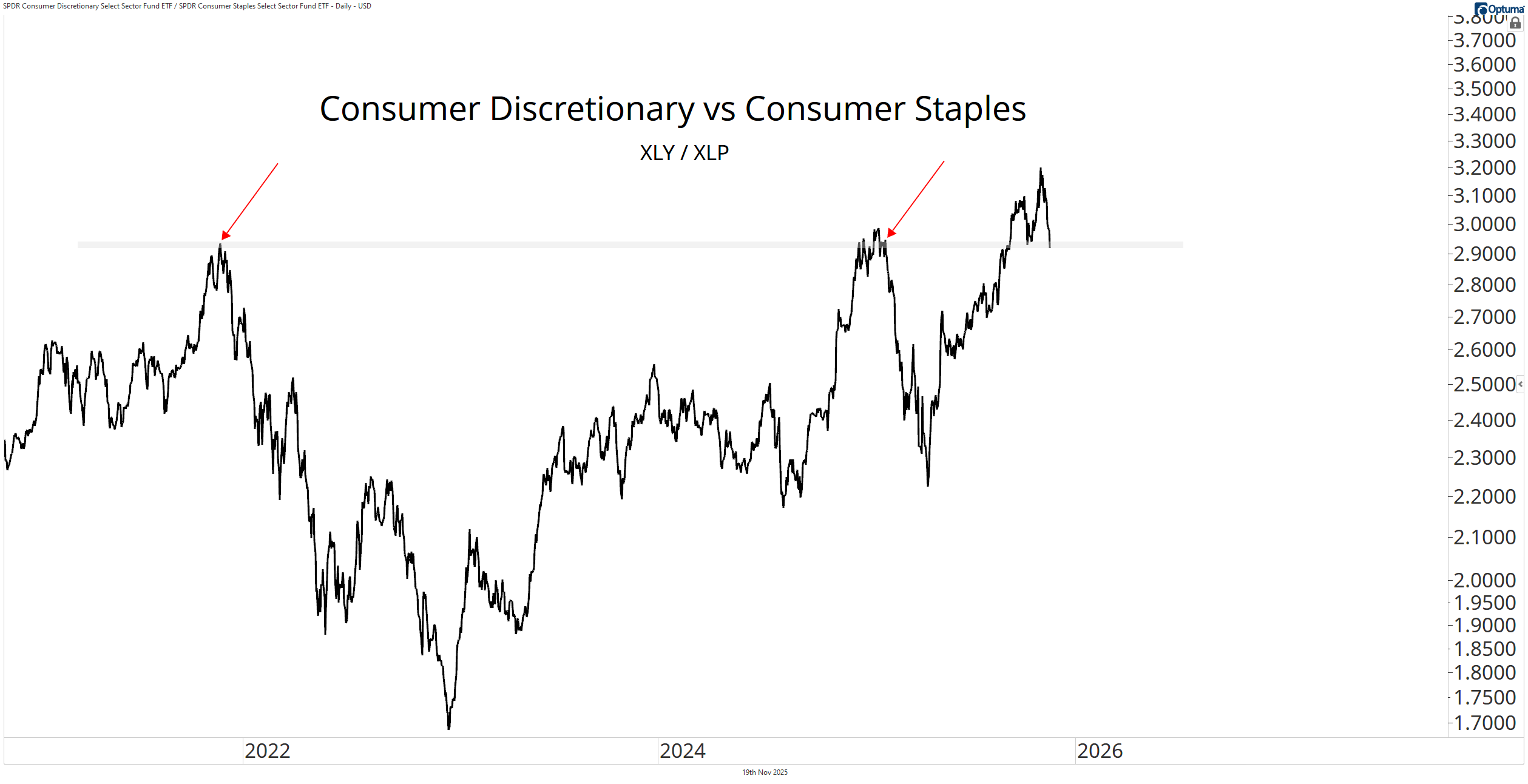

We’ve highlighted several of these setups this month, but arguably the most important for the broader market is the Consumer Discretionary vs. Consumer Staples ratio ($XLY / $XLP).

This ratio tends to rise in bull markets, as discretionary sectors outperform during periods of economic expansion, while staples lead when growth is slowing.

Right now, the ratio is sitting on a major level. A failed breakout here would carry serious implications, opening the door to deeper drawdowns across the market.

Adding to the concern, Consumer Discretionary ($XLY) made new lows today.

If the ratio follows to the downside, it would argue for a more defensive stance across the board.

If you’re tracking breadth, volatility, or seasonality, this research gives you the full context.

Review the signals now so you’re ready for what comes next.