🔎 Bulls Charge Back In

📊 Daily ETF Overview

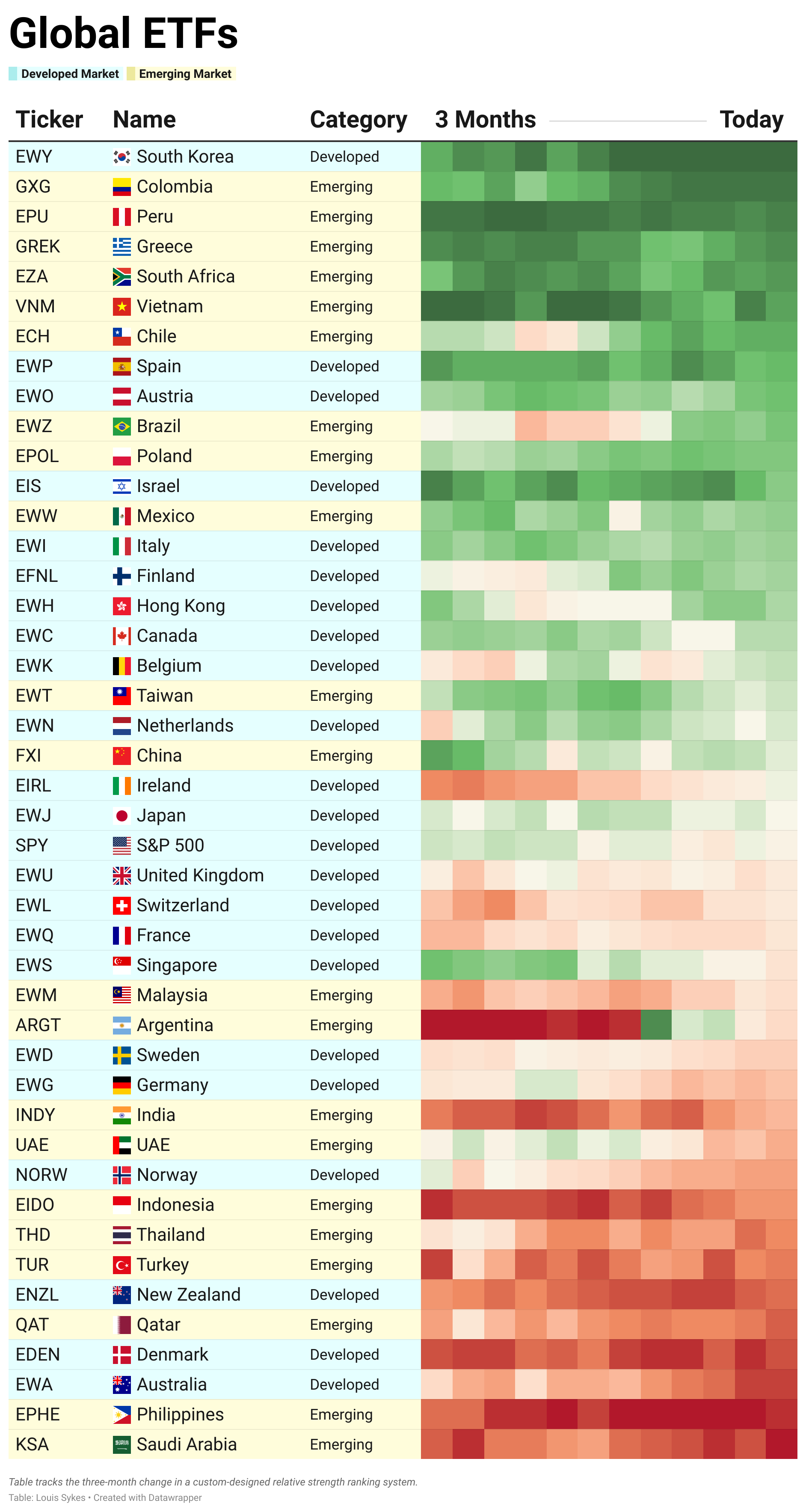

International markets continue to outpace the U.S. on our power rankings, and given two decades of U.S. dominance, this year has been a genuine outlier.

Recent strength across global equities—from Argentina’s surge, to Latin America waking up, to Europe breaking out of long-term bases—has finally rewarded investors who kept some international exposure.

The question now is whether that strength carries into 2026.

The chart below is our roadmap. It plots the FTSE All-World ex-US ETF $VEU relative to the S&P 500 $SPY. When the line rises, as it did earlier this year, the U.S. is underperforming.

Right now, the ratio sits at a key inflection point. A breakdown would suggest the long-running trend of U.S. outperformance remains intact.

But if this level holds into next year, we may be witnessing the first phase of a new, multi-year trend favoring international markets.

We’re entering the window where ASC historically finds its biggest winners.