Starbucks Report Card: Good Enough for Now

Verbal: 800. A+

"I think we'll become famous for Green Apron Service and be the defining customer service company that I think Starbucks should be. That's our mission".

Starbucks is paying associates $500,000,000 more as part of implementing a plan that involves serving coffee in less than 4 minutes, acting more friendly, and generally removing the stains created by a decade of focusing on driving adoption of the widely loathed Starbucks App. Can Starbucks regain its status as The Third Place between work and home that it once was? Probably not. But Starbucks can be a better experience than waiting in line with junkies outside a methadone clinic.

Leading a turnaround starts by giving everyone in an organization a set of firm, specific targets and setting expectations. There are 20,000 locations just in North America. You can't lead such a large army with nuance. "4 minutes or less between order and pick-up" is exactly that type of goal. Specific, measurable, not tied up in "how". Starbucks is seeing more walk-in traffic after years of making it extremely difficult for non-members to order is precisely the type of metric a CEO needs to be able to cite as evidence that the profits will come, in time, if the experience is improved.

Deep in our jaded hearts retail analysts want to believe there's a place in this world where good service matters. Niccol is feeding this idea to a receptive audience.

Will it work? I think so. Maybe, but it'll take a couple of years. Mostly, I hope it works. Hope is enough for now, as long as Niccol can project.

Math: 540. C+

Negative same-store sales in America is bad for Starbucks. 6 quarters in a row of negative comps is objectively terrible. It means Starbucks is still opening new units and inflation to improve revenues when the model is clearly broken in terms of profitability. With 40,000 Starbucks worldwide, the last thing the company needs is new locations. Unless, and this was the important part, the new stores are being built with a customer-first mindset. More drive-throughs. Less reliance on the lucrative but generally despised app.

The math part of this turnaround doesn't yet make much sense, based on what we've seen so far. "If the service is so much better than why the hell are fewer people coming into Starbucks?" is the type of question math folks would ask. Niccol has an MBA from the University of Chicago ("Where Whimsy Goes the Die"). He knows he's vulnerable on the math front, but he's also smart enough to know the right language to assuage the grumblings from those unimaginative souls who would question the idea of spending a year or two not caring about the bottom line in favor of a long-term plan.

Niccol speaks civilian and MBA/ Consultant jargon. He's ingratiating. Asked about the eventual need to raise prices, he danced past the question like a torreador. "We all remember that class we took, right? I can't remember if it's four or five Ps but one of the Ps is definitely 'Price'".

Niccol was referring to a fairly obscure marketing concept originally taught at Harvard Business School in the 40s as 5 Ps (Product, Price, Place, Promotion, People), which was later reduced to 4 P's but cutting out the People. When Niccol says "we all remember that class we took right?" he is speaking directly to the MBA-certified analysts who grade SBUX on Tuesday night for research released Wednesday morning. He was speaking the language of his audience, tossed in with a little nostalgia. "Oh, I remember the 5-P's!" I thought, almost despite myself. I'm sure I wasn't alone.

The 5 P's was an idea first taught at Harvard Business School in the 1940s. It's not remotely a thing "we all" remember. It made me feel smart just for knowing what to what the hell he was referring. It simultaneously shot down criticisms he knew he'd be facing for missing EPS estimates by a beefy 25%. It was a note-perfect Vibe for a company that's going to need a little good faith to keep the stock from crashing while this Green Apron plan kicks into gear with higher profits sometime in 2027.

You can love or hate the slickness buried in the presentation, but Niccol has a plan he can articulate well enough that any self-respecting MBA would be lame to question it, at least for another quarter or two. Anyone who can't believe in the 4 (or maybe 5) P's just doesn't understand the magnitude of this (eventually) profitable plan.

Final Score: 1340 (a B- in these SAT-inflated days)

Niccol has a plan, a vision, and a BOD of absolute lapdogs. He's going to get plenty of time to execute on his plan to make Starbucks Mid Again. Earnings are going to stay low, but the stock is probably going higher.

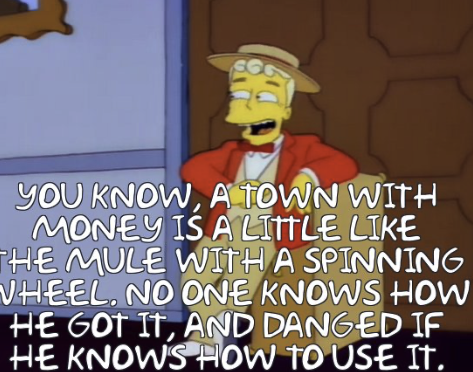

Anyone who can't see that is like a mule with a spinning wheel...

Buy anything below $85.