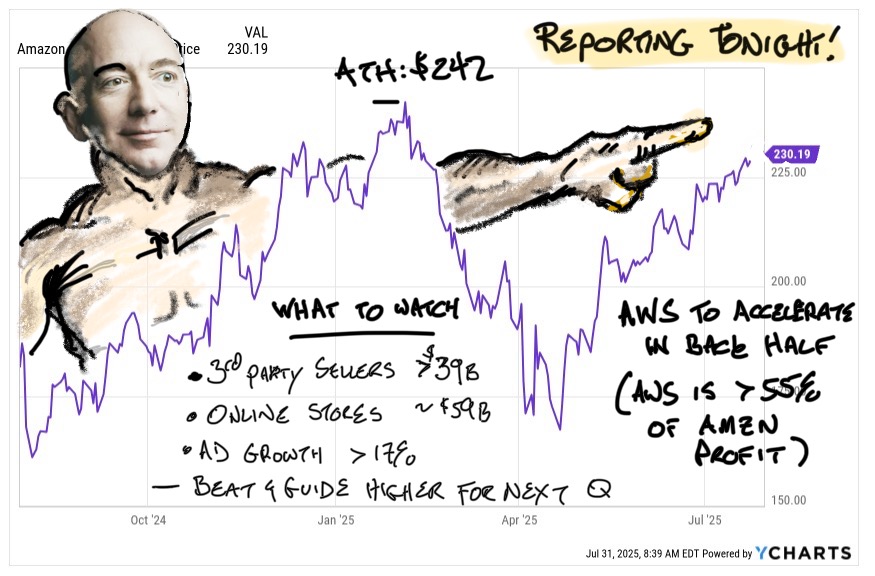

Amazon Earnings Preview!

AWS growth = or better than 17% Growth

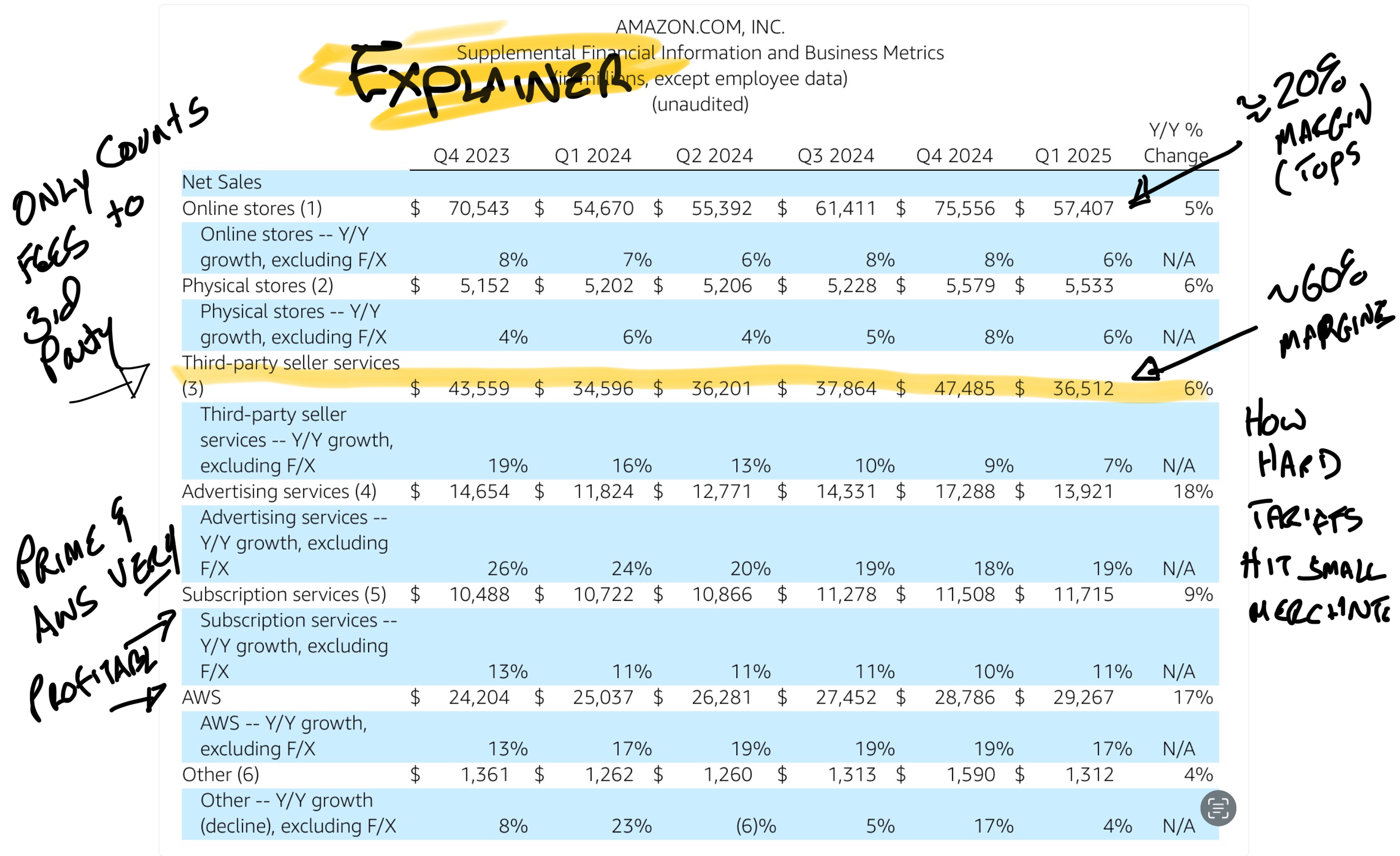

AWS is top of everyone's list for a few simple reasons. First, Google and Microsoft (Amazon's Cloud competition) crushed estimates in the quarters just reported. Second, and this is the important part, AWS and Third-party seller services are where Amazon makes most of its real money. Last year AWS was under 20% of Amazon's revenue and over half of the company's operating income. After what we saw from Microsoft and Google, Amazon either needs to come in well above estimates for AWS or have a very good reason for the miss.

Third-Party Seller Services Growth >7% Y/Y

I talk a lot about Amazon being more insulated from Tariff noise than other major retailers. Part of that is AWS but the other reason is the unbelievable amount of money Amazon makes from selling services to other retailers. Third-party services involve the processing, shipping, and web-hosting of merchants who sell on Amazon, and it's a growth monster for Amazon, both on the top and bottom line.

Amazon's Online stores accounted for ~$250b of revenue compared to "only" $156b for Third-party, but that's misleading. See, Amazon's online stores operate like a typical retail business (buying products, paying tariffs, holding inventory, and hoping to grind out maybe 5% net margins. Revenue for Online Stores is booked in the traditional manner.

But if all Amazon did was run online stores, it'd be about the size of two Targets and earn almost nothing. Third-party seller services' Net Sales number is only the fees Amazon charges other merchants. That means no inventory headaches, no real marketing, and huge, huge profits. Amazon doesn't break out the margins for Third-Party selling services but they are thought to be about 60%, compared to maybe 15% for Amazon's online stores and close to nothing for the few physical stores Amazon runs.

While Amazon's Online Stores show higher revenues, most of the actual products being moved about the country in the ubiquitous Amazon trucks come from third parties.

When the news hits tonight, I'll be scrolling to this portion of the release, way down in "Supplemental Financial Information". This will tell me two things. I'd expect Third-party to have grown faster than Online Stores, regardless of the pressure being felt by the vendors Amazon serves, mostly because Amazon is indispensable to these vendors. That means cost pressures on vendors don't hurt Amazon directly. It might even help a bit, in that it uses Amazon as a way to cut back on expensive efforts to control their own shipping. It also means Amazon can "turn the dial" on product mix, pushing more sales to Third-party as a way of controlling Amazon's rising COGs for its own stores and improving retail margins.

Amazon seeks to provide the widest selection of products at the best price. Everyone says that but Amazon means it. While the company seldom spends much time breaking out the distinction between any segment other than AWS and Advertising, focusing on the wonky stuff below the surface will tell me a lot more about the state of the consumer and how Amazon is working around tariff headwinds.

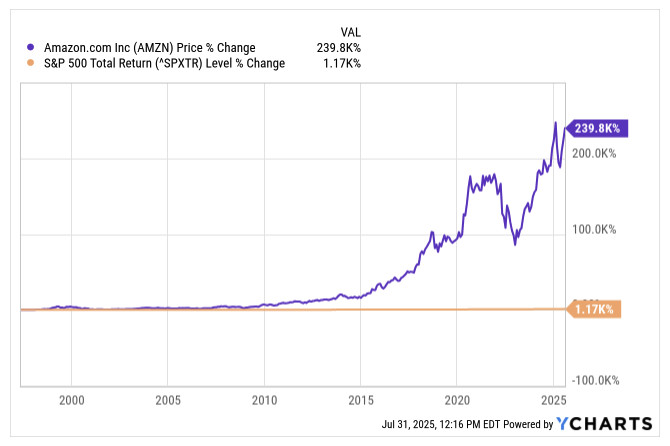

Cap-Ex over $100b

Remember how the market dinged Google (at least at first) for raising Cap-Ex? That was silly. Amazon went public with the ambition of becoming the Biggest bookstore on Earth. It's now the most profitable retailer of any sort the world has ever seen. Amazon was able to do this because it allocated capital better than anyone else. Bezos can "see around corners" and invest to capitalize on what the world will want next. That ability is now an institutionalized skill.

I don't mind Amazon spending dump trucks full of cash growing and optimizing AWS or pretty much anything else. If Amazon were still a bookstore, it's chart wouldn't look like this:

If Amazon's projected CapEx is bumped up from $100b, I'm fine with that. I'll regard it as bullish, especially if AWS outperforms.

How I'm trading Amazon

I'm currently long Amazon, and my children will have to pry it from cold, dead fingers. I spend all day looking at the consumer and retailing. It would be personally and professionally embarrassing not to be long Amazon and stuff it in a lockbox.

I think the company will report a strong quarter and see new all-time-highs, if not tonight then in the next month or two. At the moment, I've Texas Hedged the position by getting long some Calls, but I can't promise I'll still own them by the close.