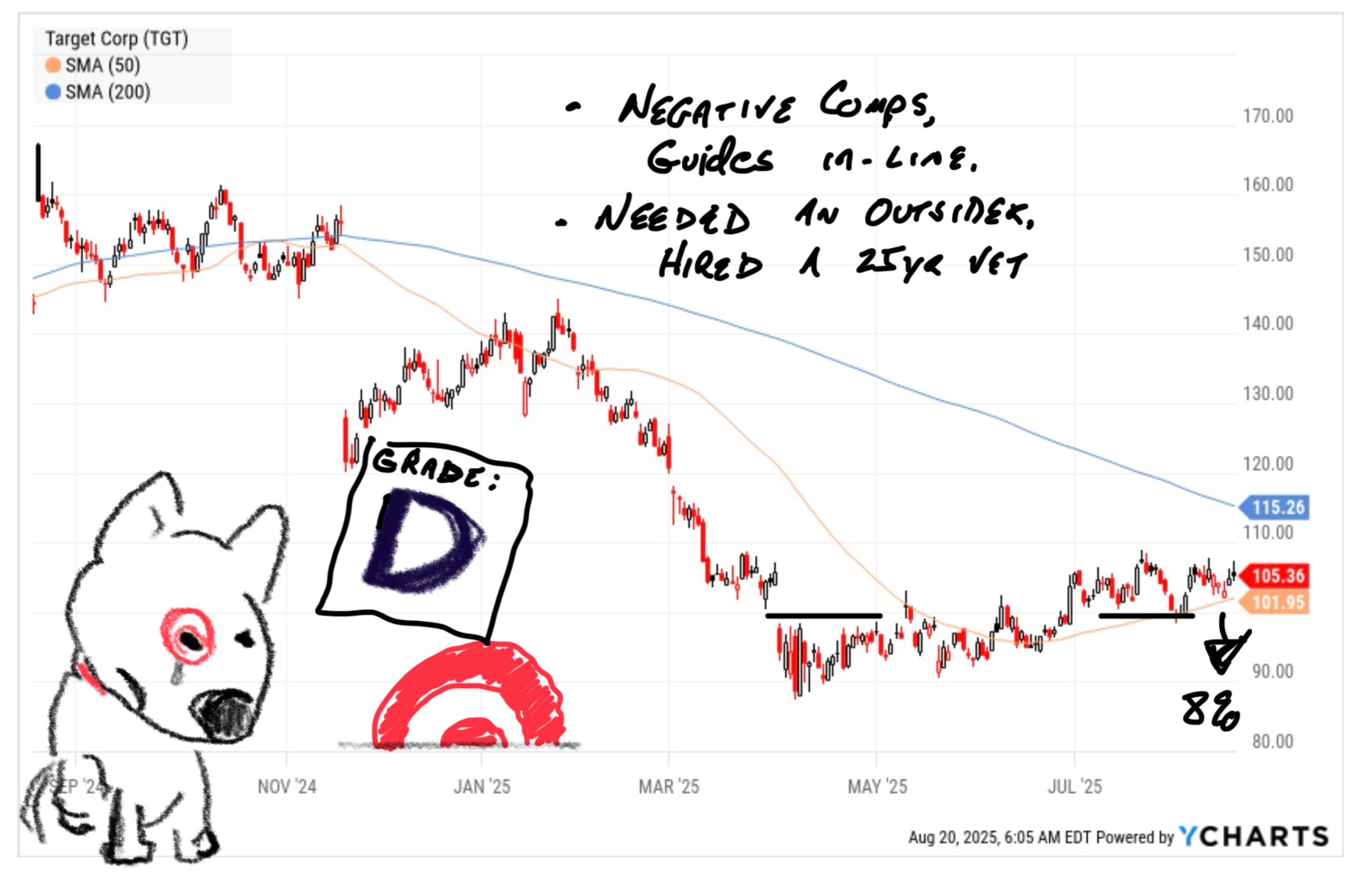

UPDATE: Target Report Card and Trade Idea

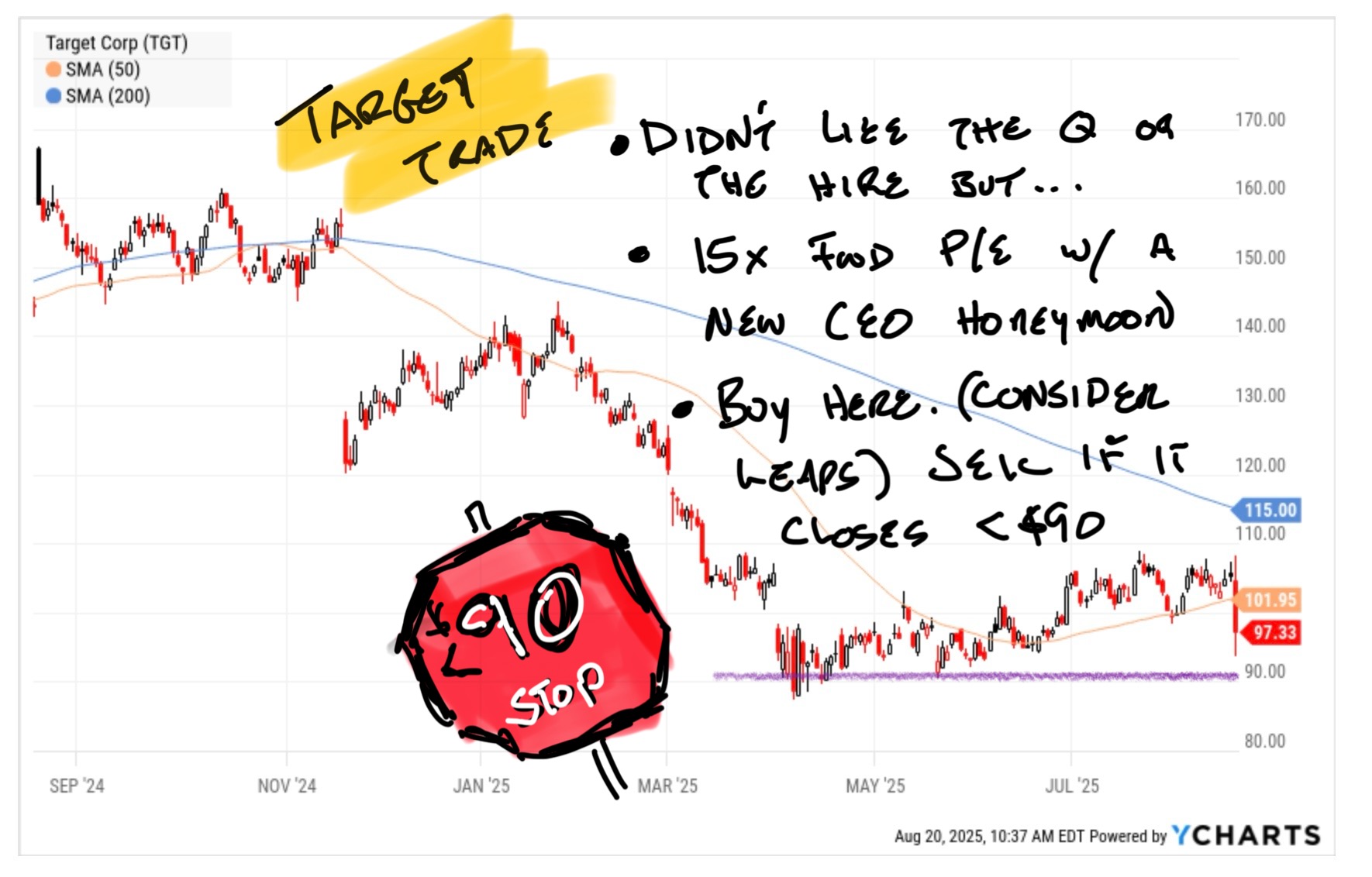

Trade: Buy Target with a Stop on a close below $90

Off the call with Target, which went about as expected. Incoming CEO Michael Fiddelke seems smart and is engaged. He clearly understands the mission and need for a 1. Better Merchandising 2. Better Store Experience 3. Getting back to growth.

Change is good for Target right now. The more Fiddelke can be proactive in messaging and deed the less it will matter if Brian Cornell is hanging on until the beginning of February. This is a nice window of opportunity for Target. Wall Street would actually welcome Fiddelke spending money if it means better stores and execution. Target shares are near the April 8th lows. The stock has priced in negative comps for the balance of the year and a disappointing succession plan. If (likely when) Target misses next quarter it will be seen as part of the Medicine Target needs to get on track.

I don't expect downgrades coming out of this report and the consumer is showing up for $TJX and $LOW, suggesting there's enough demand for Target to get back in the race.

I like taking a bite here as Wall Street is getting to know the new team better. Use a stop at the April lows. It's going to take something very bad indeed to break $TGT as a stock more than it's already broken.