Members Only: Walmart Epilogue

We're all Going to Eat the Tariffs

I say it all the time: If I could read only one economic report to base all my investing decisions on, it would be Walmart's quarterly reports. Walmart US and Sam's Club together do $1.5B in domestic retail every single day. That's over 10% of domestic core retail, more than doubling Amazon (5.2%) and Costco (3.5%).

CPI, PPI, Michigan surveys and all the other noise is based on a mix of what people are telling pollsters and/ or how bureaucrats are gathering data. Walmart's a huge company being run by smart, candid people. Last week PPI and CPI, the two "official" measures of inflation, left economists pretty much as confused as they were before the reports about whether or not inflation was coming.

Yesterday, Walmart answered the question: Yes, inflation is coming. Here's CEO Doug McMillon:

"The impact of the tariffs has been gradual enough that behavioral adjustments have been muted... As we replenish inventory at post-tariff price levels we see our costs increase every week" McMillon explained. "In discretionary categories where item prices have gone up we see more adjustments in middle and lower-income households".

That one statement told us three things:

- First, Walmart isn't going to eat the tariffs. Prices are going higher, particularly on discretionary products, the majority of which are imported.

- Second, lower-income groups are getting hit harder than others. Tariffs are a regressive tax on US consumers, at a retail level and that tax is going to increase over the next 6 months.

- Third, domestic suppliers aren't immune. Walmart is increasing "rollbacks" (price reductions) in products that aren't impacted by tariffs. So, if you're a company making a product in the US and thought you were immune, or even benefited, from tariffs on imported goods, you can still expect a call from Earth's Biggest Merchant letting you know Walmart is going to be charging less for your product and will thus be paying you less. Walmart won't make domestic take all the pain, just some of it.

Add it up and you have pinched consumers, likely making less on their businesses, being asked to pay more at stores where margins will be going lower. Walmart's margin outlook remains pretty solid, but, as an economic "tell", this wasn't good. You can argue analysts should have been expecting this turn of events already, but it wasn't a welcome confirmation to hear it from Walmart.

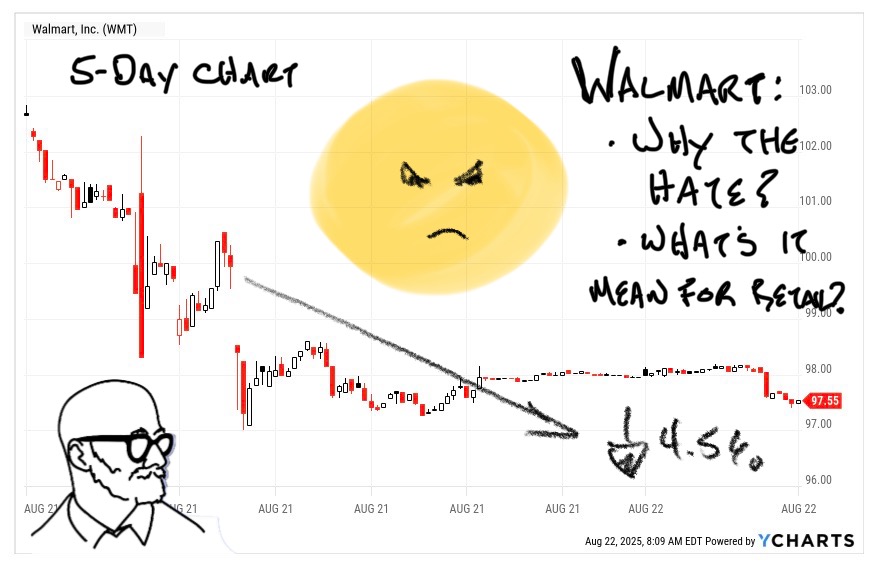

Stock Impact

I don't know the degree to which Fed Officials pay attention to Walmart over their other reams of data but they should. Walmart is >50% groceries, which are sourced domestically, for the most part. Walmart can, and plans to, ease the pain for Walmart customers by implementing price rollbacks in non-discretionary products. Other chains aren't so lucky in that regard.

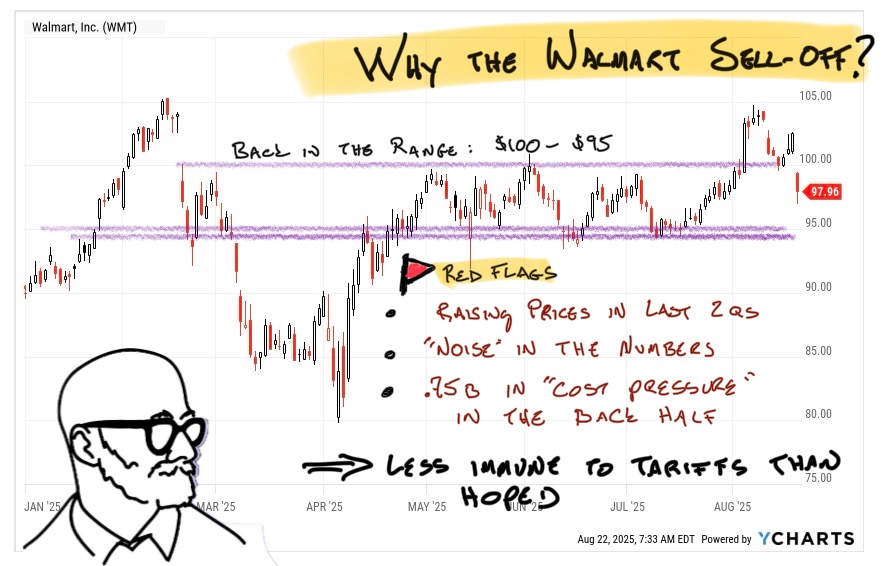

Walmart itself will be fine. The stock has been in a well-defined range from $90 to just over $100 for most of the year. I love the base being built but until Walmart is able to go out and prove it when it comes to offsetting higher cost pressure by spreading the pain to other products and minimizing the damage to the core customer at Walmart, which is still in the mid to lower end of the economic range.

Walmart's closest analogue in terms of size and resilience to tariffs is Costco. Both are huge (Costco is the 3rd largest US merchant) and have razor-thin margins in the stores. Costco makes it up with membership fees, from which is makes almost all its profits. Walmart offsets the vicissitudes of policy fate through diverse product offerings and execution.

Both are as buffered from tariff inflation as any huge retailers can be. But that doesn't make them immune to the effects.

Walmart had a great quarter and is growing into the expanded multiples being paid for the shares over the last few years. That said, inflation is the more frightening headwinds for all retailers and those two aren't an exception. In uncertain times the big players trade in synch, which is why COST and WMT have been pretty much in lockstep all year:

The Trade:

Same as yesterday. If you don't own any Walmart and are looking to add quality (at a slightly high price), I love adding in the mid-90s. Walmart noted a couple times that Back-to-School was strong, which suggests Halloween and Christmas will be good as well. If the season unfolds as expected, look for WMT and COST to start making progress around November, ahead of the 3Q reports.